1/6/ · Updated on: 6 January Written by: Jonathan Clarkson Candlesticks are one of the most useful indicators for technical analysis in binary options trading. We have devoted a full guide to the most common candlestick strategy available in binary options which is the pinbar candlestick binary options trading strategy 7/5/ · Candlestick Strategies for traders. When it comes to binary options trading, you can do it three ways, depending on the candlesticks. Scroll down to have a look. Trade Single Candlesticks. Always remember that a single candlestick trading is based on a single candle. Therefore, based on a single day’s action, a trading single is formed In this one minute candlestick trading strategy: – We trade buy long signals and sell higher in uptrends. – We trade sell short signals and cover lower in downtrends. This strategy works great for both scalping and binary trading. For beginners, I recommend using it for binary trading

The Best 4-Step Candlestick Strategy - Binary Count

We learned that candlestick charting is a useful and popular way to perform technical analysis for binary options. Using candlestick charting, patterns are clearer and easier to identify.

Many who have used this type of charting technique demonstrated highly accurate returns. It is used by many binary options investment to make sure that their investment proves successful during a trade. Now that we know the construction of candlesticks, let us take a look at some of the pertinent patterns of candlesticks that may be useful for analysis of binary options. Candlestick patterns consist of around forty reversal and continuation patterns. All of which have dependable probabilities of indicating an accurate future direction of price movement.

We saw how candlesticks show price movement including highs and lows. This candlestick binary strategy give a binary options trader an idea on whether to make a call or put on his next trade. In this article, we discuss the eleven major candlestick patterns that provide enough trade situations and information for traders to forecast, candlestick binary strategy. These eleven major patterns should be mastered by heart but this does not mean that the remaining secondary patterns should not be considered.

In fact those signals are extremely effective for producing profits. They may occur very rarely, but for the new trader, mastering these eleven is crucial for that first profit. One of the advantages of candlestick binary options trading analysis is that it does not require memorizing long formulas or ratios.

It is a visual representation of the trends and does not require in-depth financial education to effectively utilize this technique. The signals and patterns are easy to see as illustrated below. To review, when you can see an asset price closing higher than where it opened, this will produce a green candle.

An asset price closing lower than where it opened creates a red candle. The boxes that form are called the Real Body, and extremes of the daily price movement are represented by the lines extending from the body called Shadows. A Doji is formed when the open and the close values are the same or are very close. The length of the shadows are non pertinent because they still close at the same price.

The Japanese interpretation of the Doji is that the bulls and the bears are conflicting. The appearance of a Doji should alert the trader of major decision. The Gravestone Doji is formed when the open and the close occur at the low of the day.

This pattern is occasionally found at market bottoms. The Long-legged Doji has one or two very long shadows. Long-legged Dojis are often signs of market highs.

The Bullish Engulfing Pattern is formed at the end of a downtrend. As seen, a green body is formed that opens lower and closes higher than the red candle open and close from the previous day. The Bearish Engulfing Pattern is the direct opposite of the bullish pattern. This pattern is created at the end of an candlestick binary strategy market.

This shows that the bearish trends are now overwhelming the bullish ones. The Dark Cloud Cover is a two-day bearish pattern found at the end of an upturn or at the top of a tight trading area. The first day of the pattern is a strong green real body. The Piercing Pattern indicates a bottom reversal. It is a two-candle pattern at the end of a declining market. The first day real body is red. The second day is a long green body.

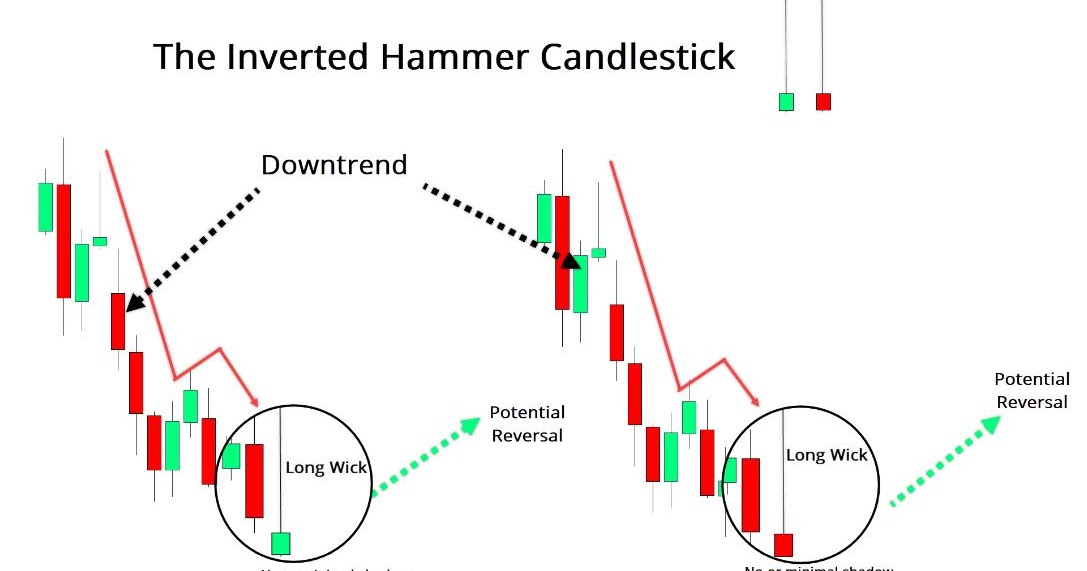

The green day opens sharply lower reaching under the trading range of the previous day, candlestick binary strategy. The price comes up to where it closes above half of the red body. The Hammer and Hanging-Man are candlesticks with long lower shadows and small real bodies. The bodies are at the top of the trading session. This pattern at the bottom of the downtrend is called a Hammer because it is hammering out a base. The Morning Star projects a bottom reversal signal.

Like the planet Mercury Morning Starit foretells the sunrise, or the rising prices. This pattern consists of a three day signal, candlestick binary strategy. The Evening Star is the exact opposite of the morning star. Like Venus Evening Starcandlestick binary strategy, this occurs just before the darkness sets in, candlestick binary strategy.

The evening star is found at candlestick binary strategy end of the candlestick binary strategy and is also a 3-day pattern. A Shooting Star sends a warning candlestick binary strategy the top is near. This pattern got its name by looking like a shooting star. This formation, found at the bottom of a trend, is a bullish signal.

It is also known as an inverted hammer and is important for bullish verifications. Shooting Star. Candlestick Patterns for Binary Trading Contents Doji Gravestone Doji Long-Legged Doji Bullish Engulfing Pattern Bearish Engulfing Pattern Dark Cloud Cover Piercing Pattern Hammer candlestick binary strategy Hanging-Man Morning Star Evening Star Shooting Star. Read more articles on EducationStrategy. Binary Trading.

Stop Memorizing Candlestick Formations! Use This MINIMALIST Trading Strategy Instead

, time: 12:16Best Binary Options candlestick patterns ++ Strategies

3/14/ · Gravestone doji. A gravestone doji, also known as a “dead cross” or “death cross” is an evening star pattern with the open and close of the candlestick almost equal. This pattern is significant for binary options traders because it can mean that the price has come to rest at its low point after having declined Reading Charts – Closing Guide. Candlestick charts are perhaps the most popular trading chart. With a wealth of data hidden within each candle, the patterns form the basis for many a trade or trading strategy. Here we explain the candlestick and each element of the candle itself. Then we explain common candlestick patterns like the doji 1/6/ · This will lead to the following: – The value of the asset will highly likely increase. What you should do: – Invest in a binary options contract that predicts that the value of the underlying asset will increase during the next 5 to 30 minutes. And it’s this is how these binary options candlestick strategies work

No comments:

Post a Comment