19/10/ · Forex for Beginners. Get My Guide. The key levels to look out for are the % and % respectively. The 50% level is not technically a 14/01/ · A Fibonacci Forex retracement, in general, is a short term price correction during an overall larger upward or downward movement. These price corrections are temporary price reversals and don’t indicate a change in the direction of the larger trend. Finding and trading retracements is a method of technical analysis used for short-term blogger.coms: 1 03/06/ · If you divide a number by the next highest number it will approximate to This number forms the basis for the % Fibonacci retracement level. If you divide a number by another two places higher it will approximate to This number forms the basis for the % Fibonacci retracement blogger.comted Reading Time: 10 mins

What Is a Fibonacci in Forex Trading and How Do You Use It?

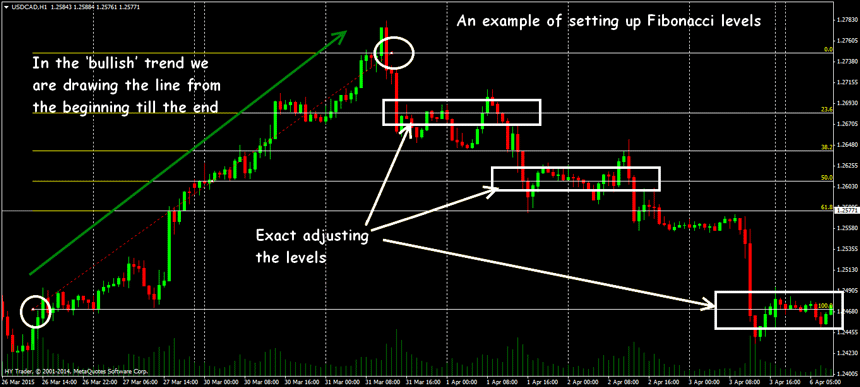

Fibonacci levels are commonly used in forex trading to identify and trade off support and resistance levels. After a significant price movement up or down, the new support and resistance levels are fibonacci en forex at or near these trend lines. From a trading perspective, the most commonly used Fibonacci levels are the In a strong trend, which we always want to be trading, fibonacci en forex, a minimum retracement is around Fibonacci numbers are nothing but a series of natural numbers, beginning with 0 and 1 and continuing infinitely.

Each next number in the series is derived by adding two previous numbers. Hence, the numbers formed are:. It is also found that whenever any number in the series is divided by its immediate predecessor, the fibonacci en forex obtained is the same, i.

This ratio is termed the Golden Ratio. For example:, fibonacci en forex. There is no specific formula to determine retracement levels.

However, traders can draw them on a stock chart by identifying the trend and considering the potential price range high or peak and low or trough for a specific asset at support and resistance levels. In the next step, they need to calculate the difference between the two prices to fibonacci en forex a target price.

Lastly, they have to multiply the resultant with a Fibonacci ratio or percentage and subtract it from or add it to the high or low price, depending on the trend. The most commonly used ratios include Based on the price trends of an asset in the financial market, traders rely on the following formula to calculate Fibonacci levels :. In that case, fibonacci en forex, the uptrend and buy order would be:. Hence, the uptrend retracement for the asset at the Fibonacci ratio Hence, the downtrend retracement for the asset at the Fibonacci ratio The retracement for different Fibonacci percentages in both trends can be obtained in the same fibonacci en forex. To start trading using Fibonacci retracement levels in an uptrend, you need to see whether fibonacci en forex price finds support at It starts moving back up towards the original uptrend.

Once you get the confirmation your ideal entry would be somewhere between Your stop-loss will be below the Likewise, for a downward trend, you can place your sell entry after the price finds resistance at While your stop loss would be above the There are many Fibonacci terms, but fibonacci en forex two of them are necessary in forex trading: extension and Retracement.

Fibonacci sequence refers to a ratio obtained by adding only two numbers to form a third number, and the second number is added to the third number to form a fourth number.

When the last number is divided by the second last number, the ratio is about 1. This is just a basic introduction to let you know how Fibonacci came about, fibonacci en forex. Every Forex trading broker will place the Fibonacci icon somewhere in their trading tools. You only need to click the icon and set the time period, currency pair or asset, and any other information that may be required by your broker to calculate the Fibonacci.

For now, you only need to know the principle or idea behind the Fibonacci retracement. The term actually means that the price of an asset Forex for us retraces back to its previous position or price level before going in its initial direction. Fibonacci retracement levels can be viewed as a point of resistance or support; while the extension level is used as a take profit level. Look at the example below:. A Fibonacci Forex tool can be a great way to find support along with price targets.

WHERE TO CONTACT US Website : www. com Twitter : www. com Email ID : info, fibonacci en forex. forextrade1 gmail. Home Uncategorized What is Fibonacci in forex. What are Fibonacci tradi From a trading perspective, the most commonly used Fibonacci levels are the Fibonacci Numbers Fibonacci numbers are nothing but a series of natural numbers, beginning with 0 and 1 and continuing infinitely.

Start Trading Fibonacci Forex Levels To start trading using Fibonacci retracement levels in an uptrend, you need to see whether the price finds support at Fibonacci Retracement and Extension There are many Fibonacci terms, but only two of them are necessary in forex trading: extension and Retracement. Look at the example below: Fibonacci Forex Conclusion A Fibonacci Forex tool can be a great way to find support along with price targets.

Como Usar Fibonacci en Forex

, time: 6:23How To Use Fibonacci To Trade Forex

14/01/ · A Fibonacci Forex retracement, in general, is a short term price correction during an overall larger upward or downward movement. These price corrections are temporary price reversals and don’t indicate a change in the direction of the larger trend. Finding and trading retracements is a method of technical analysis used for short-term blogger.coms: 1 03/06/ · If you divide a number by the next highest number it will approximate to This number forms the basis for the % Fibonacci retracement level. If you divide a number by another two places higher it will approximate to This number forms the basis for the % Fibonacci retracement blogger.comted Reading Time: 10 mins 19/10/ · Forex for Beginners. Get My Guide. The key levels to look out for are the % and % respectively. The 50% level is not technically a

No comments:

Post a Comment