![Order Blocks - forex trading strategy [updated] order block trading](https://i.ytimg.com/vi/RaFpz-1h3NY/maxresdefault.jpg)

The strongest order blocks: Take liquidity first (stop hunt) Move away aggressively. Leave a market imbalance (fair value gap) due to the large volume contained in the move. When price returns to an Order block it should react to the open or 50% region of the candle TRADABLE VS NON-TRADABLE ORDER BLOCKS. The Best Trading Strategy. WhatsApp KenneDyne spot• ABBREVIATIONS & DEFINATIONS ORDER BLOCK [OB] OB is a Down/Up Candle at/near Support or Resistance before the move Up/Down, respectively · Block Trade: A block trade, also known as a block order, is an order or trade submitted for the sale or purchase of a large quantity of securities. A block trade involves a significantly large Video Duration: 2 min

Learning To Trade The ‘Order Block’ Forex Strategy | Forex Academy

Hello Traders, So today I am doing a trade recap on a trade I lost due to lack of detail. Detail, detail, detail never forget. I have labelled the chart accordingly so your understanding can be seamless. But if you still need Why are order order block trading formed? Order blocks are created when a breakout move doesn't go to plan, order block trading.

If banks get caught in a fake breakout move, they aren't going to sit and cry about it, order block trading. Stop using order blocks that have no In this tutorial, I give a brief description on how to determine high probability orderblocks using the knowledge of liquidity voids. By the end of this video, you should be able to pin point a bullish or a bearish orderblock which has a very high probability of holding support or resistance respectively.

You will also be able to mark out inefficiencies in the This chart analysis shows you the power of order flow using two main things: OB - Order Blocks BOS - Break of Structure If you can determine a trend utilising impulse and correction, you can almost always ride the wave by scaling in positions using this method. In this example, Liquidity void, Fair Value Gap, Imbalance These terms are interchangeable. As a Charter Member ill tell you what I've shown here, is a basic depiction, as I got asked a question on what is an imbalance?

An imbalance, is an imbalance in price, where price has NOT efficiently delivered orders in the market, order block trading, price will like to revisit these areas, of order block trading, See chart for explanation.

Add confluences such as liquidity pools below OB or an OB that clearly took liquidity, order block trading. hello, so you want a model that will get you profits? LOOK NO FURTHER!!!! this is the ICT BREAKER, this mode and other confluences is ALL, YOU, NEED. if you confluence the BREAKER with what is labelled, as the purple box, THAT IS YOUR BREAKER BLOCK, YOU TRADE IN HERE WITH Today I prepared a brief lecture about the Candlestick Pattern, one of the most fundamental phenomenon and behaviors that traders Hello traders.

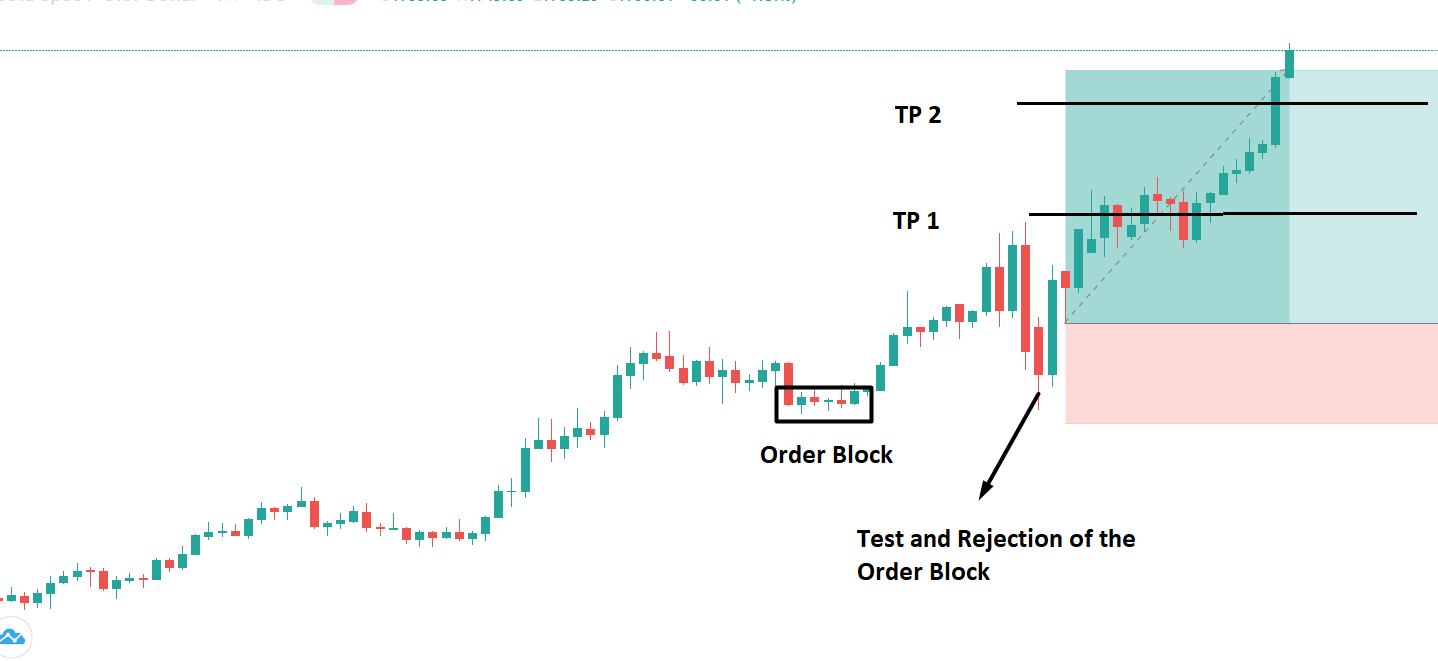

This is Tommy. Today, I prepared the most basic and at the same time essential materials that every trader should know. Trading is order block trading the act of exchanging or trading something with a certain value. If we look at the history, we humans have always traded something within the social community from the Neolithic Age to develop into a better In this example, we can see that this is a typical trend continuation move.

Bullish impulse leg, followed by a "Consolidation before breakout". Prices made a Swing High, followed by a "FALLING WEDGE" pattern, forming liquidity beneath the minor take advantage of it right away! I hope you find this insightful and helpful. Market Profiles allow you to understand the structure of price action, you can alter your profiles to be specific for buying or selling. Having a universal plan shows you where price is going to range, if it sticks to principles of order block trading action Higher Highs, Higher Lowsyou can deduce where the next levels of interest are and vice versa.

Interest areas - the Everyone is trading orderblocks these days. so how do you use orderblocks to frame a high order block trading setup for yourself?

In this video I will show you exactly what criteria I look for when framing a high probability setup. When I want to trade right off of an orderblock, there are a few things that I look for.

A Swing high or low 2. Imbalance above or Market structure is a trend-following technique that traders use to read and track how the price moves, order block trading.

Bullish moves, bearish moves, and order block trading in between Market structure is also known as price action at times. As a result, we call it market structure since that is how the entire market This was an ideal occasion for order blocks.

This one would have netted some good profit and limited risk. This isn't how I trade ordinarily. I don't often take trades off the or higher just because I almost never see an order block within my risk parameters.

I usually only use the higher time frames to chart the landscape, however, the idea of successfully Get started. Education and research. Videos only, order block trading. SEE WHY MANY PEOPLE LOST THIS TRADE AVOID IT. What is an Order Block? AlkalineFX Premium. Orderblocks and Liquidity Voids. Pheneck Pro. Simplifying Order Flow. Smart Money - POI Confirmation Entry 2 Step Method. THE ICT BREAKER! Chart Analysis is not a gambling! Reason why TA is great. Educational Content.

SharkAcademy Pro. You need to create your own Market Profile. Framing high probability setups using orderblocks. Missed gold opportunity. Good time for educating.

DERS 2 - ORDER BLOCK KAVRAMI NEDİR ? - Price Action

, time: 17:45Block Trade Definition

The strongest order blocks: Take liquidity first (stop hunt) Move away aggressively. Leave a market imbalance (fair value gap) due to the large volume contained in the move. When price returns to an Order block it should react to the open or 50% region of the candle · ORDER BLOCK FOREX. Order block forex plays a significant role in determining the market direction. It is better seen on higher timeframes; on the forex trading chart. Order block in forex is a collection and accumulation of market orders by big financial institutions and banks. These orders place a major role in setting the dominant market trend · Block Trade: A block trade, also known as a block order, is an order or trade submitted for the sale or purchase of a large quantity of securities. A block trade involves a significantly large Video Duration: 2 min

No comments:

Post a Comment