18/10/ · The exchange rate applied, which takes into account non-sterling transaction fee charged by your card provider applied could have looked like this: EUR 1 = GBP (estimate generated on 24th May ) Using this exchange rate, the final bill you’ll see on your statement totalled £ Purchase rate % p.a. (variable) Monthly fee £3 Everyday No Balance Transfer Fee Credit Card Save on balance transfers 0% interest on balance transfers for 21 months from account opening No fee to transfer a balance for the first 21 months 0% interest on purchases for 3 months from account opening No monthly account fee Representative example Pay in local currency – Santander converts to Pounds Sterling using the Visa daily exchange rates (depending on your card type) and may charge you a foreign currency conversion fee depending on the account you have. Pay in Pounds Sterling – the retailer/foreign bank will handle the conversion and may charge you a fee

Foreign Transaction Fee Calculator | Santander UK

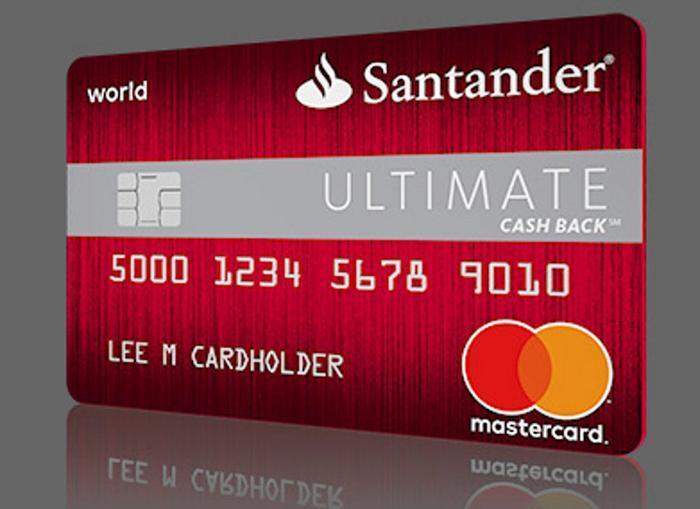

Take a look at our cards below to see which one suits you best. Minimum spend of £ applies and purchases must be made in the local currency. For more details, take a look at our cashback abroad this summer page. Check your eligibility, santander credit card exchange rate. Full details. All credit is subject to status and credit checks. Card controls in our app View your PIN, freeze your card if you lose it and block certain transactions in our mobile banking app. Account alerts We'll send you alerts when you're near your credit limit to help you avoid fees.

Skip to main content. Personal Credit cards. Credit cards We have a range of credit cards to meet your needs. A credit card could help to spread the cost of a purchase, earn cashback or save on interest payments elsewhere. Compare our credit cards The best credit card for you depends on how you want to use it. You may want to get santander credit card exchange rate to: spread the cost of purchases and more with our All in One Credit Card reorganise debt with our balance transfer credit cards or enjoy exclusive benefits with our Santander World Elite Mastercard, santander credit card exchange rate.

Representative example Representative variable Monthly fee £0 Full details. variable Monthly fee £3 Full details. Everyday No Balance Transfer Fee Credit Card Save on balance transfers. variable Monthly fee £15 Full details. Check whether you'll be accepted Use our eligibility checker today to get an idea straightaway It's completely free It'll only take you a santander credit card exchange rate minutes and you get an instant decision Your credit rating won't be affected We'll even provide an indication of your credit limit Simply choose the product you're interested in and select 'Check your eligibility'.

Giving you more - our cards also come with:. Representative Purchase rate

�� Las mejores TARJETAS DE CRÉDITO en España (2020) ���� [Puntos para volar, para PSN, Amazon, Netflix]

, time: 9:47Santander Exchange Rate: Currency Rates Overview - CurrencyFees

31/12/ · If you choose to buy your currency using a corporate card, there will be an additional fee of 2% of the value of the transaction. Cancelling an order of foreign currency or travellers cheques. £ Exchange rate markup. The exchange rate offered by Santander is confirmed when you model your transaction online Our foreign exchange services allow you to move money between different currencies and make international payments. You can rely on us whenever you need to change currency - please contact us for indicative rates on the currency you wish to exchange. Sterling, Euro or US dollars can be exchanged between your accounts, and you can receive and make ^ Mastercard exchange rate of €1 = as at 1 June ^^ Visa exchange rate of €1 = as at 1 June The exchange rates reflect the rate applicable when the payment scheme (Visa or Mastercard) processed the transaction and not the date on which the transaction took place. Remember to pay using local currency

No comments:

Post a Comment